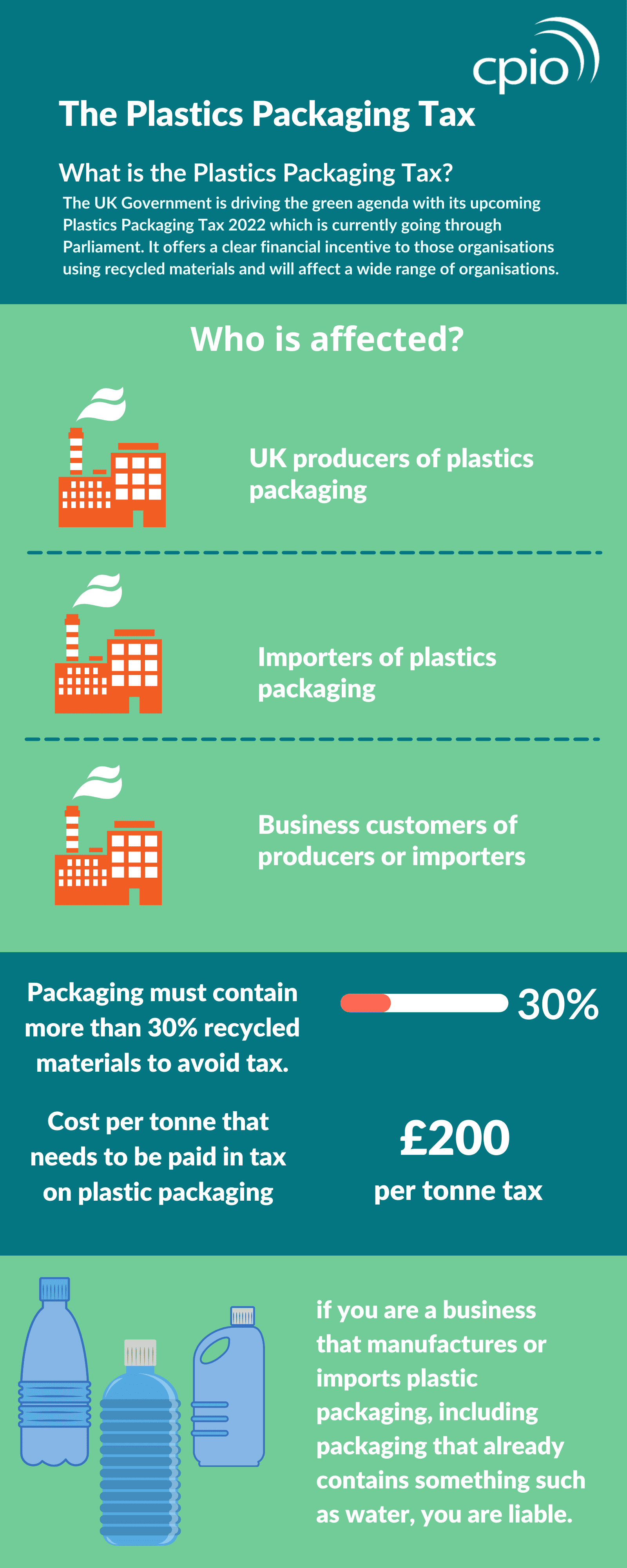

The UK government has taken a significant step in its fight against plastic pollution with the introduction of the Plastic Packaging Tax. Implemented in April 2022, this tax imposes a fee on plastic packaging containing less than 30% recycled content.

How Does it Work?

Businesses manufacturing or importing more than 10 tonnes of plastic packaging annually are subject to the tax. The rate has been steadily increasing, reaching £217.85 per tonne as of April 2024. The goal is clear: to incentivize companies to use more recycled plastic in their packaging. Then reducing plastic waste and boosts recycling rates.

The tax applies to businesses that manufacture or import 10 tonnes or more of finished plastic packaging components in 12 months. These businesses must register for the tax and pay accordingly.

The tax aims to provide a financial incentive for businesses to use more recycled plastic in their packaging, to reduce plastic waste and increase recycling rates.

A Deposit Return Scheme

While the Plastic Packaging Tax is in place, the highly anticipated deposit return scheme for plastic bottles has faced delays. Initially planned for 2023, it’s now postponed until at least 2027 as the government continues to iron out the details with industry stakeholders.

Is it Enough?

Environmental groups argue that while the Plastic Packaging Tax is a positive move, it’s not enough. They advocate for stricter measures, such as outright bans on certain single-use plastics, to effectively tackle the plastic pollution crisis.

The Plastic Packaging Tax

It’s a financial incentive for businesses to embrace sustainability. However, the road to a plastic-free future is still long. The success of this tax, coupled with complementary policies and increased consumer awareness, will be crucial in achieving a cleaner and greener environment.

What do you think about the UK’s efforts to reduce plastic waste? Share your thoughts in the comments below.