Buying your first home is a monumental milestone, whether you’re doing it solo, with a partner, or for a growing family. But along with the excitement comes a big question: How much should you borrow? The answer isn’t as simple as it might seem, and there are several factors to consider beyond just what you can technically afford.

Your Financial Comfort Zone

First things first, it’s essential to understand your financial comfort zone. Lenders might be willing to offer you a hefty loan, but that doesn’t mean you should take the maximum amount. Think about your monthly budget. How much can you realistically afford to spend on a mortgage payment without sacrificing your lifestyle?

For single buyers, it’s crucial to be honest with yourself about your financial habits. Do you love eating out, traveling, or indulging in hobbies? Make sure your mortgage doesn’t squeeze out the funds for these pleasures.

If you’re married, it’s a conversation you need to have with your spouse. Discuss your combined income, monthly expenses, and financial goals. Remember, you both need to feel comfortable with the amount, as this decision impacts your shared life together.

With kids, the stakes are higher. Consider current expenses like childcare, education, and healthcare, and think ahead to future costs. You’ll want enough room in your budget for extracurricular activities, vacations, and maybe even college savings.

The 28/36 Rule

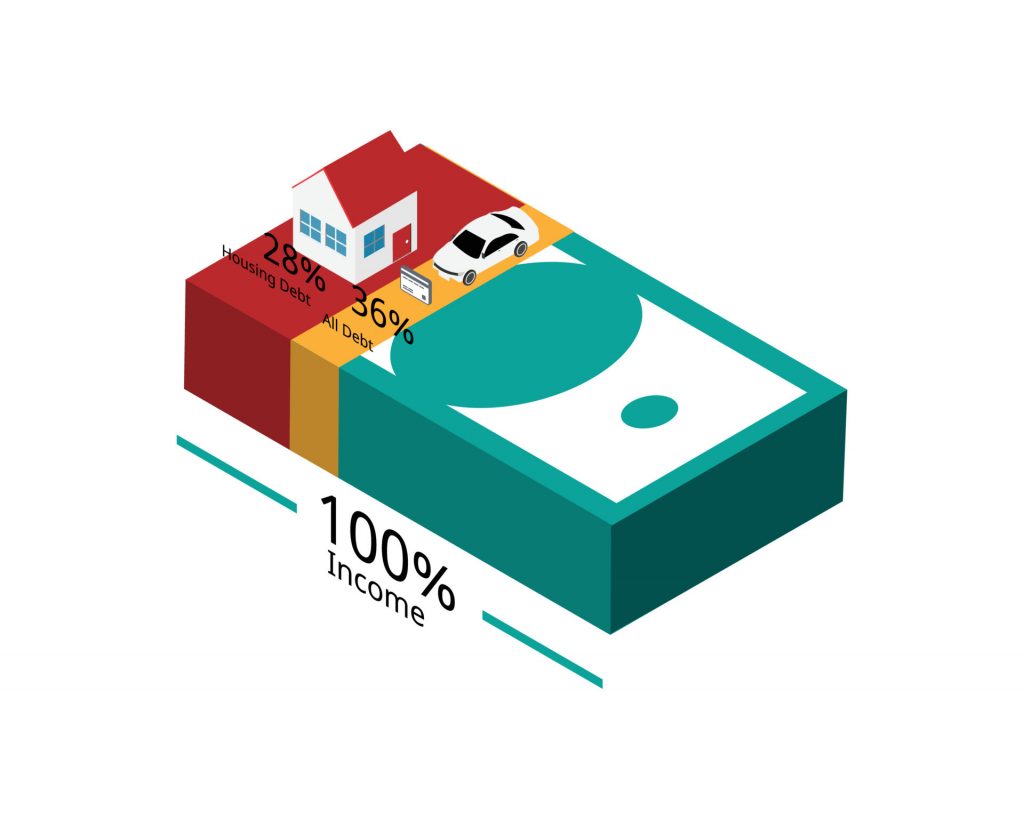

A popular guideline is the 28/36 rule. This rule suggests that you shouldn’t spend more than 28% of your gross monthly income on housing expenses and no more than 36% on total debt (including your mortgage, car payments, student loans, credit card debt, etc.). This rule is a good starting point to ensure you don’t overextend yourself.

For instance, if your gross monthly income is $5,000, your mortgage payment shouldn’t exceed $1,400, and your total debt shouldn’t be more than $1,800. Keep in mind that these numbers are guidelines, not hard-and-fast rules. They don’t account for things like unexpected medical bills, job loss, or other financial surprises.

Down Payment and Loan Type

The size of your down payment also plays a critical role in determining how big of a loan you should take out. A larger down payment reduces your loan amount, monthly payments, and the interest you’ll pay over the life of the loan. Plus, if you put down at least 20%, you can avoid the extra cost of private mortgage insurance (PMI).

Different loan types offer varying benefits. If you’re a first-time homebuyer, you might qualify for an FHA loan, which allows for a lower down payment and more lenient credit requirements. Veterans can explore VA loans with zero down payment, while conventional loans typically require higher credit scores but offer competitive rates.

Think Long-Term

When deciding on your loan size, don’t just think about today—think about the future. Are you planning to stay in this house for the long haul, or is it a stepping stone? If you expect your income to grow significantly, you might be more comfortable with a larger loan. On the other hand, if your job or family situation is uncertain, a more conservative loan might be a safer bet.

Also, consider how your home will fit into your long-term plans. If you’re single but hope to start a family in a few years, will this house meet those needs? If you’re married, how does this home align with your goals for the next decade?

Lifestyle and Location

Your lifestyle and the location you choose also play into the size of the loan you should take. If you’re eyeing a bustling city with high home prices, you might need a bigger loan. But if you’re willing to commute or live in a less expensive area, you can reduce the amount you borrow.

Remember, homeownership isn’t just about the house itself. It’s about the lifestyle that comes with it. A bigger home might mean more maintenance costs, higher utility bills, and increased property taxes. Make sure you factor these into your decision.

Emergency Fund and Other Savings

Don’t drain your savings to afford a bigger down payment or monthly mortgage. It’s crucial to have an emergency fund that covers at least three to six months of living expenses. Life is unpredictable—having a financial cushion can make all the difference if something unexpected happens.

The Bottom Line

When it comes to how big of a loan you should get for your first house, it’s about finding the right balance between your dreams and your reality. Understand your financial comfort zone, stick to the 28/36 rule as a guideline, and consider your long-term goals. Whether you’re single, married, or have kids, make sure your first home is a stepping stone to financial security, not a burden. After all, a house is more than just a place to live—it’s a foundation for your future.