Death benefits are a crucial aspect of financial planning, providing essential support for your loved ones in the event of your passing. We will explore death benefits, why they matter, and when you should start considering them.

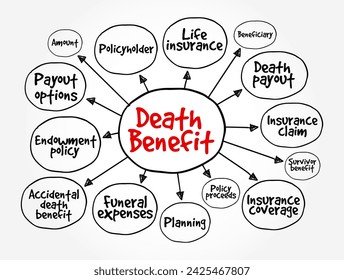

What is a Death Benefit?

A death benefit is a payment is the beneficiaries of a life insurance policy or retirement account upon the policyholder’s or account holder’s death. This financial safety net is to help surviving family members manage expenses.

- Funeral costs

- Outstanding debts

- Mortgage payments

- Education expenses for children

- Everyday living costs

Types of Death Benefits

- Life Insurance Death Benefits: They pay us from a life insurance policy fund, which can be either term (coverage for a specified period) or whole life (coverage for the insured’s lifetime).

- Retirement Account Death Benefits: These are funds that beneficiaries receive from retirement accounts, such as IRAs or 401(k)s, after the account holder’s death.

Additional Support Available in the UK

In the UK, there are various benefits and financial supports available when someone dies:

- Bereavement Support Payment: This replaces previous benefits like Widowed Parent’s Allowance and Bereavement Allowance. It is available if your partner has died.

- Child Benefit: You may continue receiving Child Benefit if a child or parent dies.

- Funeral Expenses Payment: This helps with funeral costs for those on a low income.

- Guardian’s Allowance: This provides extra money if you’re looking after a child whose parents have died.

- Children’s Funeral Fund for England: This fund covers funeral costs for children under 18.

- Statutory Parental Bereavement Pay and Leave: Employed parents may be entitled to time off work and financial support if their child dies.

- Universal Credit: This can provide support with living costs, including after someone’s death.

- Widowed Parent’s Allowance: If you are already receiving this, your payments will continue until you are no longer eligible.

- War Widow(er) Pension: This is available if your partner dies due to their service in the armed forces.

When Should You Consider Death Benefits?

The right time to consider death benefits can vary based on individual circumstances, but generally, it’s wise to start thinking about them in your 30s or 40s. Here are some factors to consider:

1. Life Changes

- Marriage: If you’re married, your spouse may rely on your income, making death benefits more critical.

- Children: Starting a family creates additional financial responsibilities, making it essential to secure their future.

- Homeownership: If you own a home, a death benefit can help cover mortgage payments for your family.

2. Financial Obligations

- Debt: Consider any loans or credit card debt that could burden your loved ones.

- Dependents: If you have dependents, their financial well-being should be a priority.

3. Health Considerations

- Age and Health: As you age or if you have health concerns, obtaining life insurance may become more costly, making it advantageous to secure coverage earlier.

Benefits of Early Consideration

- Lower Premiums: The younger and healthier you are, the lower your life insurance premiums are likely to be.

- Peace of Mind: Knowing your loved ones will be financially protected can alleviate stress and worry.

Conclusion

Understanding death benefits and recognizing the right time to consider them is vital for effective financial planning. Starting in your 30s or 40s is generally advisable, especially as life circumstances change and financial responsibilities increase. By securing death benefits early, you can ensure that your loved ones are safe and financially secure in the event of your passing.

Review your financial situation regularly and consult with a financial advisor to determine the best approach for your needs. Taking proactive steps now can lead to greater peace of mind and security for you and your family in the future. Follow for more!