Nvidia’s Staggering Single-Day Drop

Nvidia, the leading chipmaker in the AI industry, experienced a massive sell-off on Tuesday. Resulting in a market capitalization loss of $279 billion – the largest single-day drop in market value for a U.S. company. This plunge reportedly cost Nvidia’s CEO, Jensen Huang, an estimated $9.8 billion.

Potential Antitrust Concerns

The market’s reaction was further exacerbated by reports that the U.S. Department of Justice had subpoenaed Nvidia and other companies for evidence, amid concerns over potential antitrust violations. The Justice Department and the Federal Trade Commission are reportedly investigating Nvidia’s business practices. The company has made it difficult for customers to switch chip providers.

Investor Disappointment and the AI Boom

Nvidia’s shares continued to fall in after-hours trading, with revenue of $30 billion for fiscal year 2025, which was up 122% from a year ago. However, Nvidia’s third-quarter revenue guidance of $32.5 billion, plus or minus 2%. It was slightly above the average analysts’ expectations but below the top-end estimates.

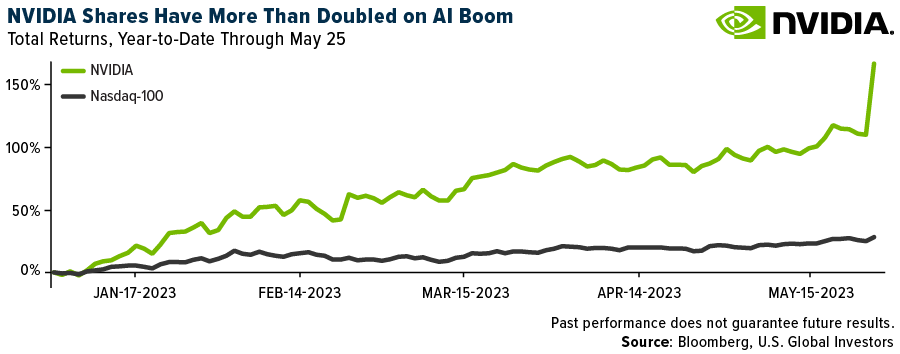

The chipmaker’s shares have been rising in the past year due to optimism surrounding the artificial intelligence (AI) boom, which is expected to drive increased demand for semiconductors and memory to keep up with the rising computational requirements for AI applications. Nvidia, with its dominance in the AI data centre chip market, has been at the forefront of this trend.

Broader Impact on the Chip Sector

Nvidia’s plunge had a ripple effect on the broader chip sector. Other major players such as Intel, Marvell, Broadcom, AMD, and Qualcomm are all experiencing significant declines. The VanEck Semiconductor ETF (SMH), an index that tracks semiconductor stocks, also suffered its worst day since March 2020, dropping 7.5%.

Nvidia’s Rebound and the Potential for Volatility

Despite the massive sell-off, Nvidia‘s shares rebounded by over 5% during mid-day trading on the following day, putting the company back behind Microsoft and Apple as the most valuable company in the world. However, this volatility is not uncommon for Nvidia, as the company’s stock has experienced similar dips and rebounds in the past, often proving its doubters wrong.