Picture this: You’re at the pharmacy, ready to pick up a life-saving prescription, but the medication isn’t available. Not because of a sudden spike in demand or a distribution hiccup, but because the entire supply chain has moved halfway around the world.

As more pharmaceutical manufacturing plants set up shop in Asia, Europe is facing an uncertain future for its drug supply. How did we arrive at this pivotal moment, and what could it mean for your next prescription?

The Shifting Landscape: Why Asia?

The migration of pharmaceutical manufacturing to Asia, particularly China and India, has been driven by the quest for lower production costs and advanced technological capabilities. European pharmaceutical companies have flocked to these regions to capitalize on cost efficiencies and scalability, allowing them to redirect resources into groundbreaking research and development.

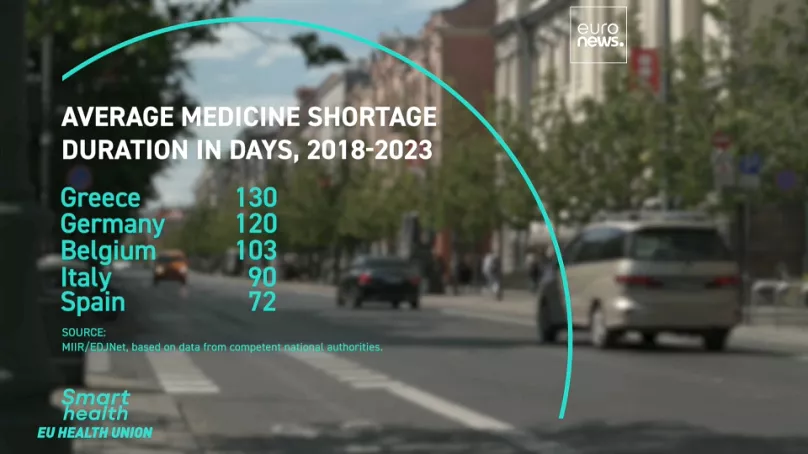

Yet, this global shift brings with it a complex set of challenges. Europe’s growing dependence on Asian manufacturing could lead to significant risks, including drug shortages that impact patient care across the continent.

The Shortage Threat: What’s at Stake?

As Europe leans more heavily on Asian drug manufacturers, several critical risks emerge:

- Vulnerable Supply Chains: The global supply chain for pharmaceuticals is intricately linked, and disruptions—whether from natural disasters, geopolitical conflicts, or pandemics—can have cascading effects. A hiccup in Asian production could spell trouble for European drug supplies.

- Quality Control Concerns: Despite many Asian manufacturers adhering to high standards, there have been instances where quality and regulatory compliance have fallen short. This can lead to recalls and gaps in availability, impacting patient health.

- Geopolitical Uncertainties: Dependence on a single region heightens vulnerability to geopolitical tensions and trade disputes. A trade embargo or diplomatic fallout could disrupt the flow of medications to Europe.

Lessons from the COVID-19 Pandemic

The COVID-19 pandemic was a stark reminder of how fragile global drug supply chains can be. During the crisis, EU member states faced severe drug shortages, which led the European Commission and other stakeholders to investigate the underlying reasons for these shortages and develop strategies to address them.

The pandemic revealed several critical issues:

- Global Supply Chain Disruptions: Lockdowns and restrictions in major manufacturing hubs caused significant delays and interruptions in the supply of raw materials and finished products.

- Overreliance on Specific Regions: The EU’s dependence on certain regions for drug production became a glaring issue. This overreliance highlighted the need for a more diversified and resilient supply network.

- Increased Demand and Panic Buying: The surge in demand for specific medications, coupled with panic buying, exacerbated shortages. The uneven distribution of essential drugs highlighted the need for better forecasting and inventory management.

- Manufacturing Constraints: The rapid increase in demand outpaced the ability of many manufacturers to scale up production, revealing limitations in capacity and production processes.

- Regulatory and Administrative Hurdles: The pandemic complicated regulatory approvals and coordination between national and European bodies, further exacerbating shortages.

Responding to the Crisis: EU Initiatives and Strategies

In response to these challenges, the European Commission and other stakeholders have implemented several key strategies:

Strengthening Supply Chain Resilience: The EU has invested approximately €8 billion in creating a more robust and diversified supply chain through its Horizon Europe program. This funding supports the development of advanced technologies for real-time supply chain monitoring and predictive analytics. According to a 2023 report, these investments are aimed at reducing supply chain disruptions by up to 30% over the next five years.

Enhancing Transparency and Monitoring: The European Medicines Agency (EMA) has introduced new reporting requirements for pharmaceutical companies, mandating that they provide monthly updates on inventory levels and supply forecasts. A recent survey indicated that 85% of pharmaceutical companies are now compliant with these new reporting standards, leading to a 20% improvement in the ability to predict and manage shortages.

Supporting Local Production: The EU’s push to boost local pharmaceutical manufacturing is evident from the €1.5 billion allocated to new manufacturing facilities and technology upgrades within Europe. This includes the construction of several new production plants, with a goal to increase Europe’s drug production capacity by 25% by 2025. For instance, the new biopharmaceutical facility in Belgium is expected to add 20% more production capacity for critical vaccines and treatments.

Improving Regulatory Processes: The EU has streamlined regulatory procedures to expedite drug approvals, cutting the average approval time from 210 days to 150 days for critical medicines. This has been achieved through the implementation of fast-track pathways and enhanced collaboration with national agencies. A recent report noted a 40% increase in the number of expedited approvals since these measures were introduced.

Promoting Stockpiling and Strategic Reserves: The EU has established a strategic reserve of essential medications, with a target of holding a three-month supply of critical drugs at all times. This reserve is managed through a network of national and regional stockpiles, which have already proven effective in mitigating shortages during recent disruptions. In the last year, stockpiles were able to cover 95% of the shortfall during supply interruptions, according to EU data.

Encouraging International Collaboration: The EU has enhanced international cooperation through new agreements with global partners. This includes participation in the COVID-19 Vaccines Global Access (COVAX) initiative, where the EU has contributed €2 billion towards global vaccine distribution. Collaborative efforts with the World Health Organization (WHO) and other international bodies have led to improved coordination and information sharing, reducing global drug shortages by an estimated 15%.

Fostering Innovation in Drug Production: Investments in innovative manufacturing technologies, such as continuous flow production and digital manufacturing techniques, have been a key focus. The EU is funding research projects with a total budget of €500 million aimed at developing these technologies. These innovations are expected to enhance production flexibility and reduce response times to supply disruptions by up to 40%.

Navigating Forward: Securing Europe’s Drug Future

Europe stands at a critical juncture in its pharmaceutical landscape. The move towards Asian manufacturing offers economic benefits but also introduces new vulnerabilities. The COVID-19 pandemic has underscored the need for a more resilient and adaptable drug supply system.

By diversifying supply chains, enhancing regulatory oversight, investing in local production, and implementing strategic stockpiling, Europe can better manage risks and ensure a steady, reliable drug supply. As the continent navigates these challenges, the focus will be on turning these strategies into action, securing a future where patient care remains uninterrupted and robust. Europe’s response to the lessons learned from the pandemic will be pivotal in shaping a more secure and resilient pharmaceutical landscape for years to come.