Hurricane Helene has caused an estimated $10 billion in total property damage, with over $3 billion predicted to be covered by insurance claims.

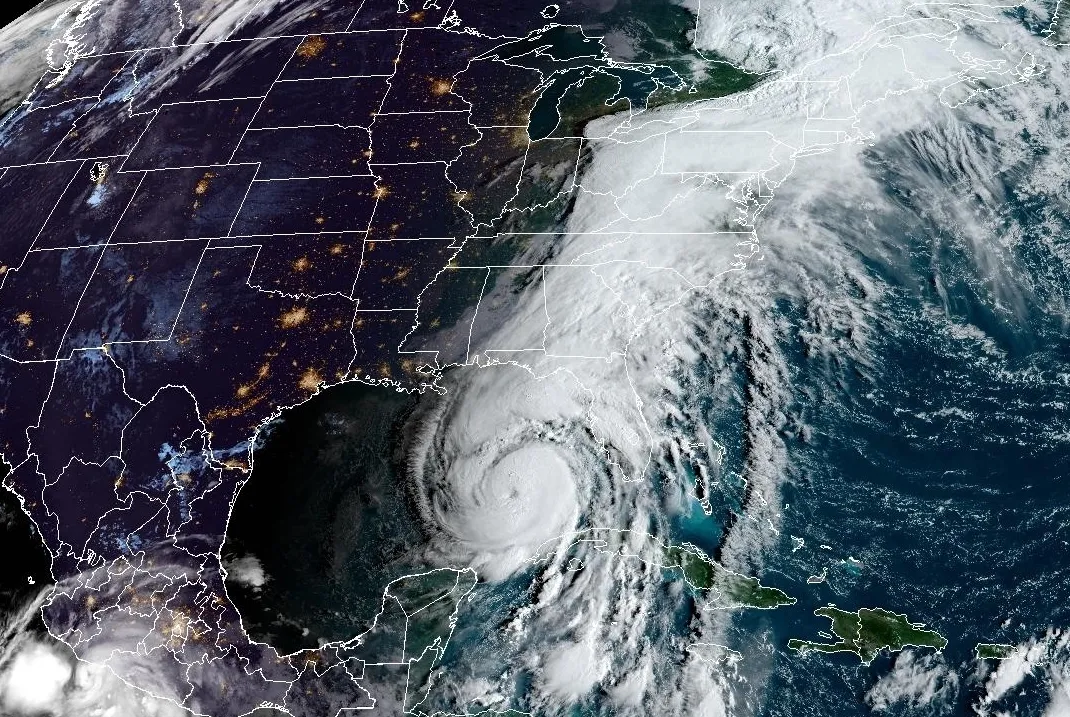

The devastation left in the wake of Hurricane Helene is a stark reminder of nature’s unpredictability. As the storm, which landed as a Category 4 hurricane, ravaged the Southeastern U.S., it left behind catastrophic damage, from destroyed homes to flooded neighborhoods, killing more than 200 people. Beyond the human toll, the financial impact on individuals and communities is staggering. Many survivors now face the harsh reality of rebuilding their lives in a post-storm world—without the safety net they desperately need.

Fewer than 2% of homeowners in the most affected areas had flood insurance, highlighting a critical gap in coverage. The death toll has risen to over 200, with thousands of residents displaced due to severe flooding and the collapse of infrastructure. Many are now left financially vulnerable as they struggle to rebuild in the aftermath

The Insurance Gap Crisis

One of the most glaring issues emerging from Helene’s aftermath is the critical gap in insurance coverage, particularly flood insurance. Despite warnings about the increased risks from storms, fewer than 2% of residents in the hardest-hit areas had flood insurance. This is a familiar problem, as homeowners across the U.S. often underestimate the need for such coverage. This under-insurance stems from misconceptions about risk, especially for those who do not live directly on the coastline but who are still vulnerable to floods, as seen in this disaster.

A common refrain from homeowners is, “I never thought it would happen to me.” Helene has proved, once again, that extreme weather events are not bound by historical patterns. Rivers swelled, rainfall overwhelmed drainage systems, and even areas that had never experienced such floods were devastated. The government’s National Flood Insurance Program (NFIP) has been criticized for not doing enough to expand coverage and educate the public, but even with existing programs, many properties are left uninsured, pushing homeowners into deeper financial turmoil.

Financial Recovery and the Insurance Industry’s Role

For those who did have insurance, relief teams were on-site almost immediately after the storm cleared, assessing damage and assisting in claim filing. The catastrophic loss model used by insurers predicted billions in claims, but actual costs are expected to far exceed this. However, not all is bleak. While insurance can never fully replace lives or eliminate emotional loss, it can aid in rebuilding homes, restoring infrastructure, and supporting the economy.

The hurricane also highlighted some of the unsung roles that insurance companies play in disaster recovery. Beyond just financial payouts, insurance firms often dispatch specialized catastrophe (CAT) response teams to areas hit by large-scale events like Helene. These teams help coordinate temporary shelter, rebuild key infrastructure, and ensure prompt support to policyholders. The quicker this assistance comes, the faster a community can start rebuilding—both physically and emotionally.

The Government’s Role and Future Preparations

Helene has sparked renewed debate over the government’s role in disaster preparedness and recovery. While federal aid is crucial in large-scale disasters, the immediate local response often reveals the gaps in preparation and resources. In North Carolina, for instance, a swift response by state authorities helped save lives, but for many homeowners, the lack of flood insurance and the extent of the damage leaves them with few options for recovery.

With the climate crisis driving more extreme weather events, governments must adapt policies and regulations to protect vulnerable communities. This includes not only stronger building codes and better infrastructure but also insurance policies tailored to emerging risks. Some experts argue that mandatory flood insurance for all homeowners in disaster-prone areas, subsidized by the government, could be a solution, though this idea faces significant political and financial hurdles.

Fraud and Scams: Post-Storm Caution

In the chaos of post-Hurricane Helene, another problem has emerged: fraudulent schemes targeting vulnerable survivors. Scammers often take advantage of the confusion, offering false assistance or posing as official contractors. Price gouging, where vendors charge exorbitant rates for essential goods and services, has also been rampant. Local governments are warning residents to be cautious and urging them to verify anyone offering assistance.

Lessons Learned: Preparing for the Future

Hurricane Helene has once again shown that preparedness is key in facing natural disasters. Homeowners need to reassess their insurance coverage, especially in areas prone to flooding or severe weather. Meanwhile, insurance companies must continue innovating, offering more tailored solutions, and educating consumers about the true risks they face.

The storm is also a wake-up call for governments at all levels to invest in better infrastructure, enforce stricter building regulations, and explore new ways to subsidize and expand insurance coverage. As the climate continues to change, these discussions will only become more urgent.

In the end, the aftermath of Hurricane Helene underscores the critical need for a more comprehensive approach to disaster preparedness and recovery. Communities, governments, and insurers must work together to close gaps in coverage, streamline response efforts, and ensure that when the next storm inevitably comes, people are better protected and more resilient.