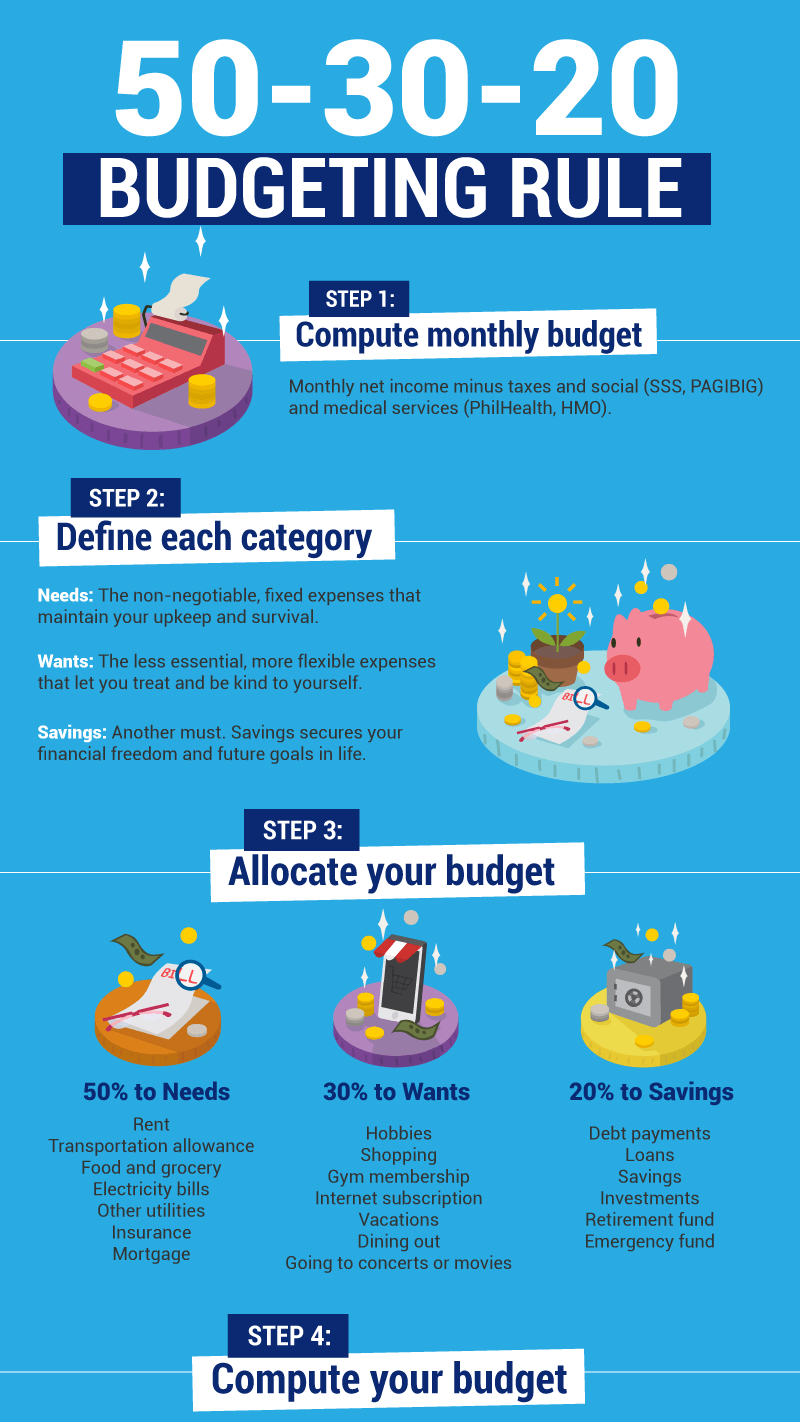

Managing personal finances can often feel overwhelming, but the 50/30/20 budgeting rule offers a straightforward approach to help you take control of your money. This method divides your after-tax income into three essential categories: needs, wants, and savings. By following this simple framework, you can achieve financial stability and work towards your long-term goals.

Understanding the 50/30/20 Budget

The 50/30/20 rule breaks down your income as follows:

- 50% for Needs: This portion covers essential expenses, such as housing, utilities, groceries, transportation, and health insurance. It’s crucial to differentiate between what you truly need and what you might want to avoid overspending in this category.

- 30% for Wants: This segment is allocated for non-essential expenses that enhance your lifestyle. This includes dining out, entertainment, and hobbies. While it’s important to enjoy life, maintaining discipline in this area is vital for your overall financial health.

- 20% for Savings and Debt Repayment: The final portion of your income should be directed towards savings, investments, and paying down debt. This could involve contributing to retirement accounts, building an emergency fund, or making extra payments on loans.

Benefits of the 50/30/20 Budget

Adopting the 50/30/20 rule comes with several advantages:

- Simplicity: The rule is easy to understand and implement, making it accessible for anyone, regardless of their financial background.

- Flexibility: This budgeting method can be adjusted to fit different income levels and financial goals, allowing you to tailor it to your unique situation.

- Balanced Financial Life: By categorizing your income, you ensure that you cover your essential needs while allowing for discretionary spending and savings, promoting a well-rounded financial lifestyle.

Implementing the 50/30/20 Budget

To start using the 50/30/20 budgeting rule, follow these steps:

- Calculate Your After-Tax Income: Determine your monthly income after taxes. This is the amount you will use to allocate into the three categories.

- Limit Your Needs to 50%: Review your monthly expenses and ensure that your needs do not exceed 50% of your income. If they do, consider ways to reduce these costs, such as downsizing or finding more affordable options.

- Adjust Your Wants: Track your discretionary spending and ensure it stays within the 30% limit. This might require cutting back on luxury items or finding less expensive alternatives for entertainment.

- Prioritize Savings and Debt Repayment: Aim to direct at least 20% of your income towards savings and debt repayment. Automating your savings can help you stick to this goal without the temptation to spend.

Example of the 50/30/20 Budget in Action

Let’s consider an example to illustrate how the 50/30/20 rule works in practice. Imagine you have a monthly after-tax income of $3,500. According to the 50/30/20 rule:

- Needs (50%): You would allocate $1,750 for essential expenses like rent, utilities, and groceries.

- Wants (30%): You would set aside $1,050 for discretionary spending on dining out, entertainment, and hobbies.

- Savings (20%): Finally, you would direct $700 towards savings and debt repayment, ensuring you build a financial cushion for the future.

Conclusion

The 50/30/20 budgeting rule is a powerful tool for anyone looking to improve their financial situation. By categorizing your income and adhering to these simple guidelines, you can achieve a balanced financial life that allows for both enjoyment and security. Start implementing this method today to pave the way for a more stable economic future.

Read more on Lifetips.blog