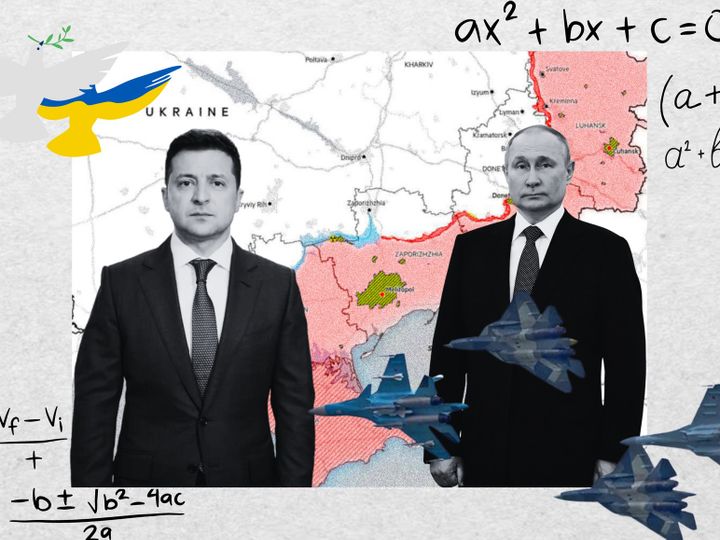

As tensions between Ukraine and Russia escalate, European stock markets feel the effects. The geopolitical landscape is shifting, and investors are closely monitoring developments. Here’s a look at how these tensions are influencing European financial markets.

Increased Market Volatility

The ongoing conflict has led to heightened volatility in European stock markets. Investors are reacting to news and developments related to the situation, which can cause significant fluctuations in stock prices. For instance, the pan-European Stoxx 600 index has shown mixed performance, reflecting a cautious sentiment among traders as they navigate the uncertainty surrounding the conflict.

Sector-Specific Reactions

Different sectors within the European markets are responding variably to the heightened tensions. Industries closely tied to energy, defence, and commodities may experience different impacts compared to consumer goods or technology sectors. For example, energy stocks might see gains due to rising oil and gas prices, while sectors reliant on stable geopolitical conditions may suffer losses.

Geopolitical Uncertainty

The uncertainty stemming from the Ukraine-Russian conflict contributes to a broader sense of instability in Europe. This geopolitical risk can deter investment and lead to increased market risk, as investors weigh the potential for further escalation or economic fallout. The recognition of Ukrainian territories by Russia in February 2022 marked a significant turning point, leading to immediate negative reactions in European stock prices.

Limited Immediate Impact

Despite the rising tensions, some analysts suggest that the immediate impact on European capital markets has been somewhat limited compared to earlier phases of the conflict. This indicates that while investors are wary, they may not be reacting as dramatically as they did at the onset of the war. However, the situation remains fluid, and any significant developments could quickly change market dynamics.

Long-Term Outlook

Looking ahead, the ongoing conflict is expected to keep European markets on edge. With no imminent peace talks and expectations of continued fighting, the uncertainty is likely to influence trading strategies and investor sentiment shortly. The potential for further sanctions and economic repercussions will also play a critical role in shaping market responses.

Conclusion

The recent increase in Ukraine-Russian tensions has created a complex environment for European stock markets. While volatility and sector-specific reactions are evident, the overall immediate impact appears to be contained. However, the long-term outlook remains uncertain, and investors will need to stay vigilant as the situation develops.

Read more on Lifetips.blog