In today’s fast-paced world, managing your finances effectively is crucial for achieving your financial goals. Fortunately, several applications help you track your spending, set budgets, and reach your financial objectives. Here’s a look at some of the best options available.

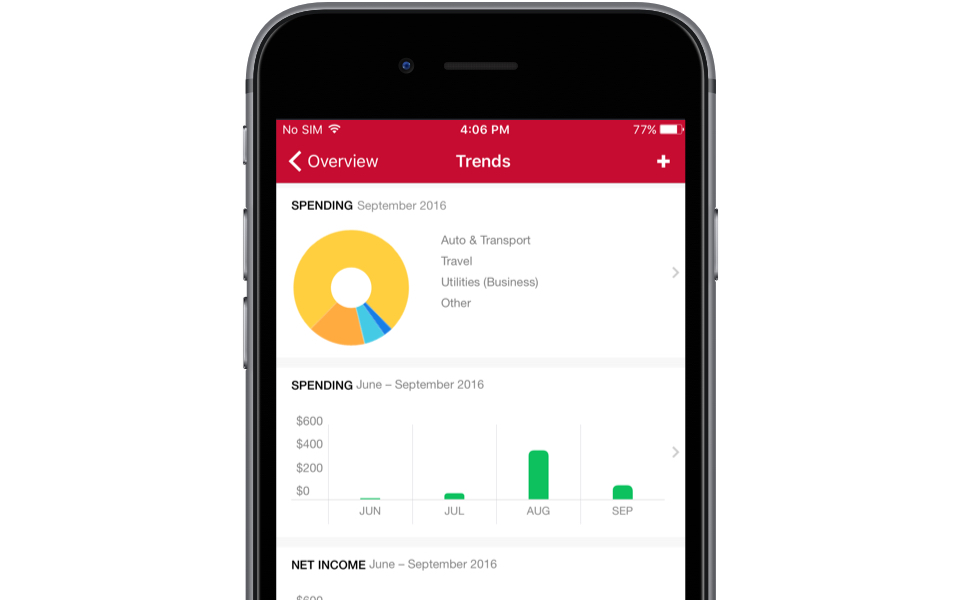

1. Mint Personal Finance & Money

Mint is one of the most popular personal finance apps, boasting around 10 million downloads. It allows users to connect various financial accounts, including bank accounts and credit cards, to track spending in real time. Mint provides powerful charting tools and automatically categorizes transactions, making it easy to see where your money goes. Additionally, you can set financial goals, such as saving for a vacation or paying off debt, which helps keep you motivated.

2. You Need a Budget (YNAB)

YNAB is a budgeting app that emphasizes proactive financial management. It operates on a budgeting system, where every dollar is assigned a specific job, whether it’s for bills, savings, or investments. YNAB offers a 34-day free trial, after which it costs $109 per year. Users appreciate its educational resources and community support, which can help them learn effective budgeting strategies.

:max_bytes(150000):strip_icc()/ynab4_report_spending_category-56a2f0ff3df78cf7727b3f60.png)

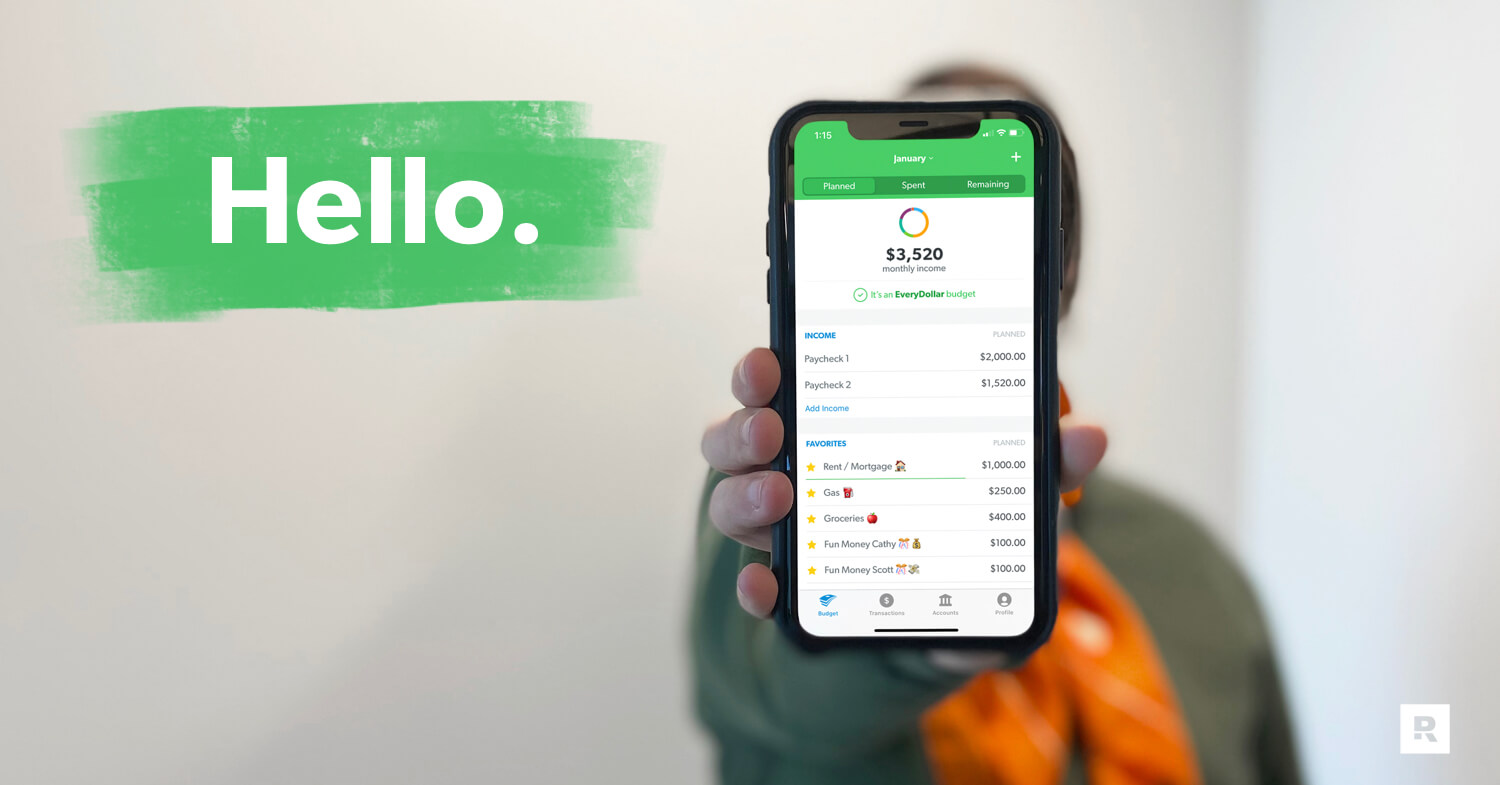

3. EveryDollar

Created by financial expert Dave Ramsey, EveryDollar is designed to simplify budgeting. The app provides a straightforward interface with eight main budgeting categories, allowing users to track their income and expenses easily. EveryDollar offers a free version that requires manual entry of transactions, while the premium version, EveryDollar Plus, costs $99 per year and includes automatic transaction tracking.

4. Quicken

Quicken is a comprehensive financial management tool that has been around for decades. It offers robust budgeting features, investment tracking, and bill payment options. Quicken allows users to sync their financial accounts across devices, providing a holistic view of their finances. Pricing starts at $39.99 for the Starter Edition, making it a versatile option for those looking to manage their finances more effectively.

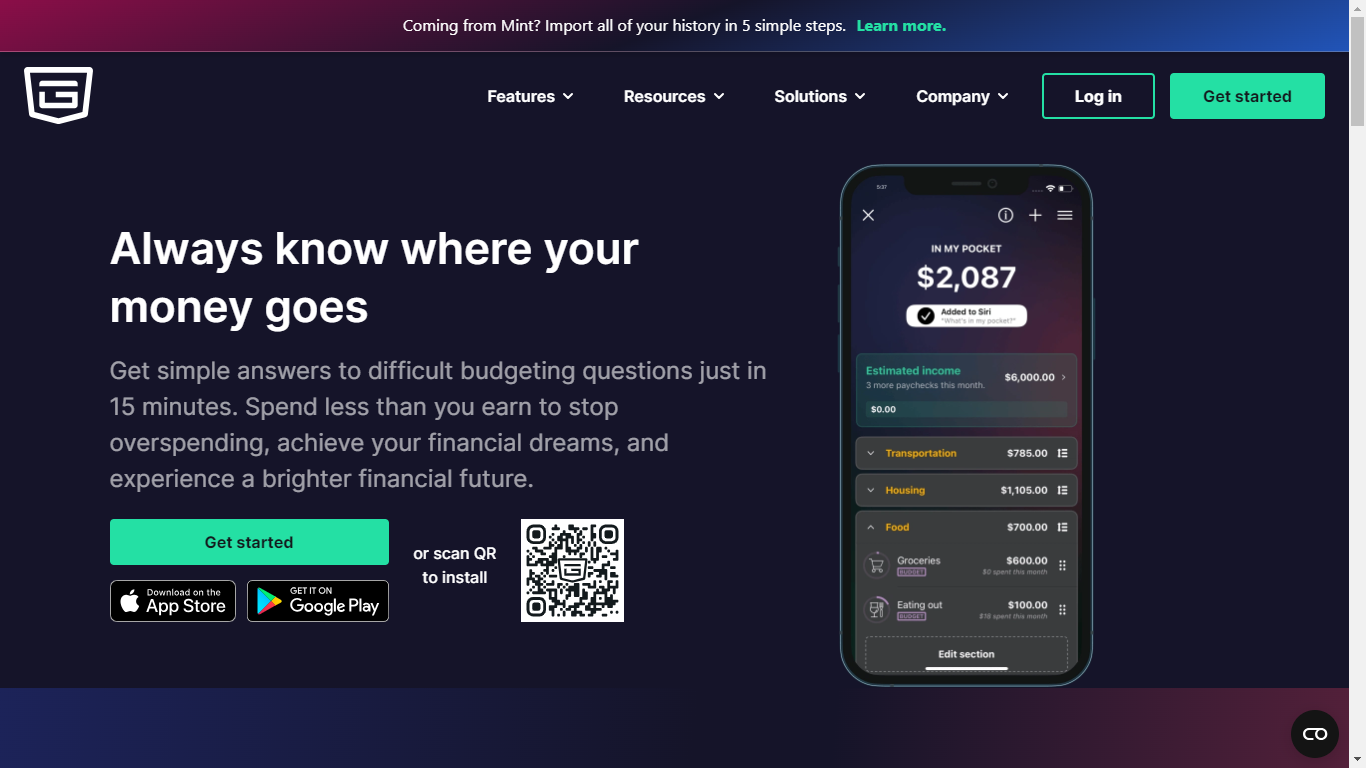

5. PocketGuard

PocketGuard is an app designed to help users understand how much disposable income they have after accounting for bills, goals, and necessities. Its “In My Pocket” feature uses an algorithm to show how much you can spend without going over budget. The basic version is free, while the premium version costs $12.99 per month or $74.99 per year.

6. Money Manager Expense & Budget

This app is optimized for personal account management, allowing you to track expenses, set budgets, and view your spending tendencies graphically. It supports multiple currencies and offers backup options via email and iCloud

Conclusion

Choosing the right financial tracking app can significantly impact your ability to manage your finances and achieve your goals. Whether you prefer a comprehensive tool like Quicken or a straightforward budgeting app like EveryDollar, there are plenty of options available to suit your needs. By leveraging these tools, you can take control of your financial future and work towards your aspirations.

Read more on Lifetips.blog