Tesla’s stock has faced a downturn recently, with shares plummeting approximately 45% in 2025 alone. This decline can be attributed to several interrelated factors that have raised concerns among investors and analysts alike.

Factors Behind Tesla’s Stock Slump

One of the primary reasons for Tesla’s stock slump is the increased competition in the electric vehicle (EV) market. Tesla was once the undisputed leader in the EV space. It is now facing fierce competition from both automakers and new entrants, particularly from China and Europe. These competitors are capturing market share with comparable or superior vehicle offerings, which has negatively impacted Tesla’s sales globally.

Sales figures tell a troubling story for Tesla. The company has experienced a notable decline in sales across major markets. For instance, sales in Europe fell by 47% in January compared to the previous year. Sales in China dropped by 29% during the first two months of 2025. In the U.S., sales decreased by 16% from December to January, indicating a worrying trend for the company. This decline in sales is concerning given that Tesla’s growth is reliant on its ability to expand its market presence.

Another factor contributing to Tesla’s stock slump is the brand damage resulting from Elon Musk’s political associations. Musk’s close ties to former President Donald Trump and the Department of Government Efficiency (DOGE) have alienated many of Tesla’s traditional customers who lean politically left. This has led to protests and vandalism against Tesla vehicles, further harming the brand’s reputation. The perception of Tesla as a politically charged brand may deter potential buyers who do not align with Musk’s political views.

Investor sentiment has also shifted dramatically in light of these developments. Many investors are concerned about Musk’s visibility and polarizing role in the Trump administration, leading to a reassessment of Tesla’s growth prospects. The stock’s volatility is exacerbated by heavy trading from retail investors, who can react emotionally to news and events, further contributing to the stock’s decline.

Trump’s Support for Tesla

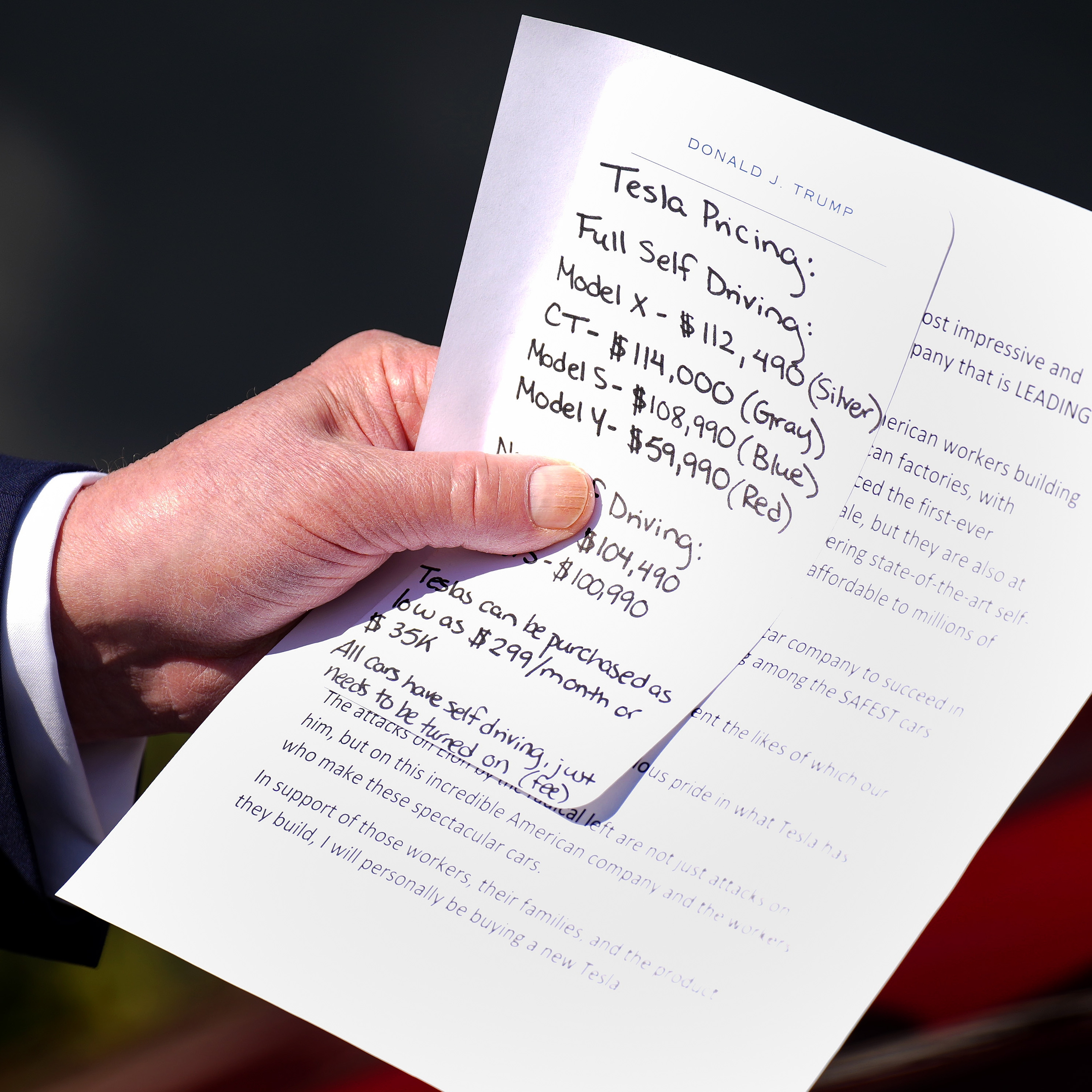

In these challenges, Donald Trump has publicly expressed support for Tesla and its CEO, Elon Musk. His motivations for this support appear to be multifaceted. Trump views Tesla as a symbol of American innovation and economic strength, and by backing Musk, he aims to rally his base against what he describes as a “boycott” against Tesla by “Radical Left Lunatics”. This political endorsement may resonate with some of Trump’s supporters, but it could also alienate others who are uncomfortable with the association.

Additionally, Trump has reportedly purchased a Tesla. This act during a press conference was a personal endorsement of the brand. This gesture could potentially influence public perception and investor confidence in Tesla, even as the company grapples with declining sales and increasing competition. Some analysts believe that Trump’s backing could lead to favorable regulatory conditions for Tesla, particularly regarding the approval of self-driving technology, which could provide a much-needed boost to the company’s prospects.

In Conclusion

Tesla’s stock slump is the result of a combination of increased competition. Declining sales, brand damage from political associations, and shifting investor sentiment. While Trump’s support for Tesla may offer some potential benefits. So, the company faces some challenges as it navigates this turbulent landscape.

Read more on Lifetips.blog