The global push for green investments has never been more critical. In recent years, nations have grappled with how to balance economic growth and environmental responsibility. During his presidency, Joe Biden made climate action a central policy, initiating significant investments in green energy and promising to drive the U.S. toward a cleaner, more sustainable future. However, under the leadership of Donald Trump, who returned to office in 2024, the future of green investments in the U.S. faces an uncertain trajectory, marked by potential shifts away from renewable energy and international climate agreements.

Biden’s Green Investments: A Legacy of Progress

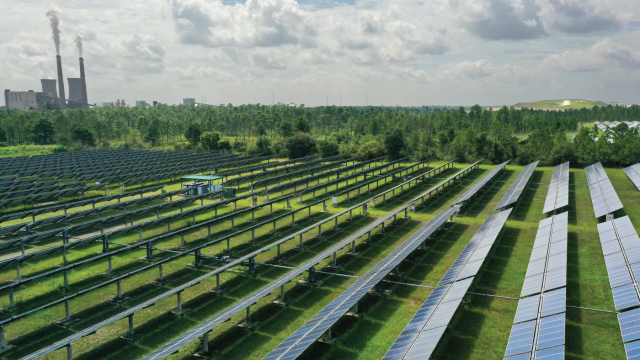

During Biden’s tenure from 2021 to 2024, his administration made bold strides in advancing the U.S. toward a more sustainable energy future. In 2022, the Inflation Reduction Act (IRA) was passed, injecting a historic $369 billion into green energy initiatives. This was the largest federal investment in U.S. climate action, targeting a 40% reduction in carbon emissions by 2030. The IRA focused on clean energy tax credits, investments in electric vehicle (EV) infrastructure, and the expansion of renewable energy sources like solar and wind. This package also allocated significant resources for research in green technologies, aiming to boost innovation in carbon capture and storage.

Beyond the IRA, Biden rejoined the Paris Climate Agreement, signaling to the world that the U.S. was committed to global efforts to limit global warming. Biden’s actions were aligned with the growing global trend of increasing green investments. By 2023, the Global Sustainable Investment Alliance (GSIA) reported that sustainable investments in the U.S. had reached $19 trillion, a significant jump from previous years. This surge reflects not only a shift in U.S. policy but also a broader international demand for clean energy solutions.

The private sector also embraced this green shift. Venture capital funding for renewable energy startups reached $60 billion in 2023, reflecting growing investor confidence in the green economy. States like California, New York, and Texas led the way in adopting aggressive clean energy policies, such as expanding EV infrastructure and incentivizing solar power adoption.

Trump’s Return: A Shift in Climate Policy

In 2024, Donald Trump returned to the presidency, marking a dramatic policy shift. Trump has repeatedly criticized international climate agreements like the Paris Accord, claiming they harm U.S. businesses by imposing unfair regulations. His administration made it clear that fossil fuels would continue to play a central role in the U.S. energy strategy. Trump’s “America First” energy policy revived the focus on domestic oil and gas production, deregulation, and the promotion of coal and natural gas over renewable energy.

On climate agreements, Trump has made it clear that he intends to withdraw from the Paris Agreement once again. His administration sees international climate commitments as economically harmful, arguing that they disadvantage U.S. industries in the global marketplace. Furthermore, Trump’s policy continues to prioritize energy independence, which includes bolstering U.S. fossil fuel production through reduced restrictions on drilling, fracking, and coal mining.

Under Trump’s leadership, the government has shifted away from incentivizing renewable energy projects and towards rolling back regulations that limit carbon emissions. For instance, he has already signaled intentions to cut back on the clean energy tax credits that were expanded under the IRA. Additionally, his administration has pursued efforts to scale back environmental regulations that were seen as stifling business growth, including re-evaluating rules related to air pollution and carbon emissions from power plants.

The Future of Green Investments Under Trump

With Trump now in office again, the question is: will green investments continue to grow, or will they reverse course?

Under Trump, fossil fuel investments are likely to increase. Trump’s administration has long championed oil, gas, and coal as key drivers of the U.S. economy. This includes efforts to promote the fracking boom and expand U.S. oil exports, which could undermine some of the clean energy advances made under Biden. The fossil fuel industry is a significant contributor to U.S. employment, and Trump’s policies are expected to continue prioritizing these jobs over investments in green sectors, which may be seen as less job-intensive.

However, green investments may not entirely vanish. The private sector continues to be a major driver of the transition to clean energy. Global demand for renewable energy is increasing, and even with Trump’s focus on fossil fuels, the U.S. remains a key player in the solar, wind, and electric vehicle industries. Tech giants like Tesla, NextEra Energy, and First Solar are likely to continue innovating and driving investments in renewable energy, irrespective of the political climate. Moreover, many states and local governments remain committed to green energy goals and may push forward with their own climate plans, independent of federal policies.

What’s at Stake for Green Investments in 2024?

Under Biden, the U.S. took significant steps to position itself as a leader in the global green economy. These investments were seen not just as climate action, but as economic opportunity. The clean energy sector was projected to create millions of jobs, particularly in renewable energy, electric vehicles, and energy storage technologies.

However, with Trump’s return to office, those gains face considerable challenges. If Trump’s policies are fully enacted, there could be significant reductions in federal investments in green technologies, fewer incentives for clean energy adoption, and a stronger focus on fossil fuels. That could put the U.S. behind other nations that are doubling down on renewable energy, such as China and the European Union.

Conclusion: A Pivotal Moment for Green Investments

In 2024, the U.S. finds itself at a critical juncture. Under Biden, significant strides were made in transitioning the country toward a cleaner, more sustainable energy future. But with Trump’s return to power, those advances face potential setbacks. The global transition to renewable energy is already underway, and the private sector’s momentum in clean tech may not be easily undone. However, the political winds have shifted, and the extent to which the U.S. embraces—or retreats from—green investments will largely depend on how federal policies evolve in the coming years. The choice between fostering a green economy or doubling down on fossil fuels will define the U.S. role in the global climate fight for decades to come.